Tech Slowdown Explained, Part 3: Endgame! 🤯

What do interest rates, inflation, quantitative easing, and...beeple have in common?

We’ve looked at interest rates. We’ve looked at inflation. We also looked at the not-so-invisible hand of the government in using monetary policy to influence both. Today, we’ll wrap things up by looking at the topic we started off this whole field trip with: how all of this led to the tech sector slowdown! 🚂

ZIRP FTW!

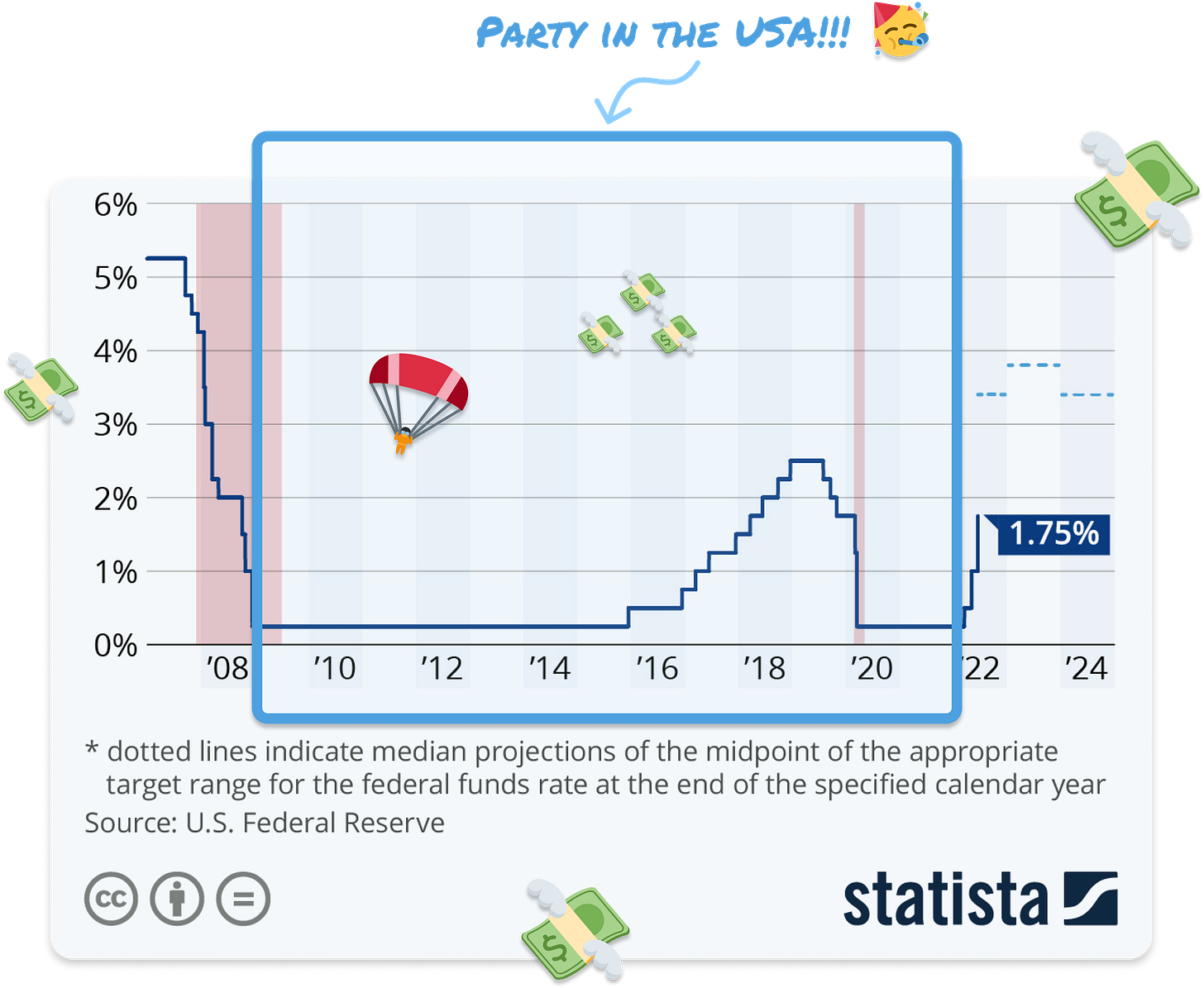

For reasons starting with the 2008 financial crisis, economic hiccups in 2011, pandemic lockdowns, and political convenience, the United States and large parts of the world lived under a zero interest rate policy (aka ZIRP). This meant that the rate banks borrowed from the central bank was essentially zero:

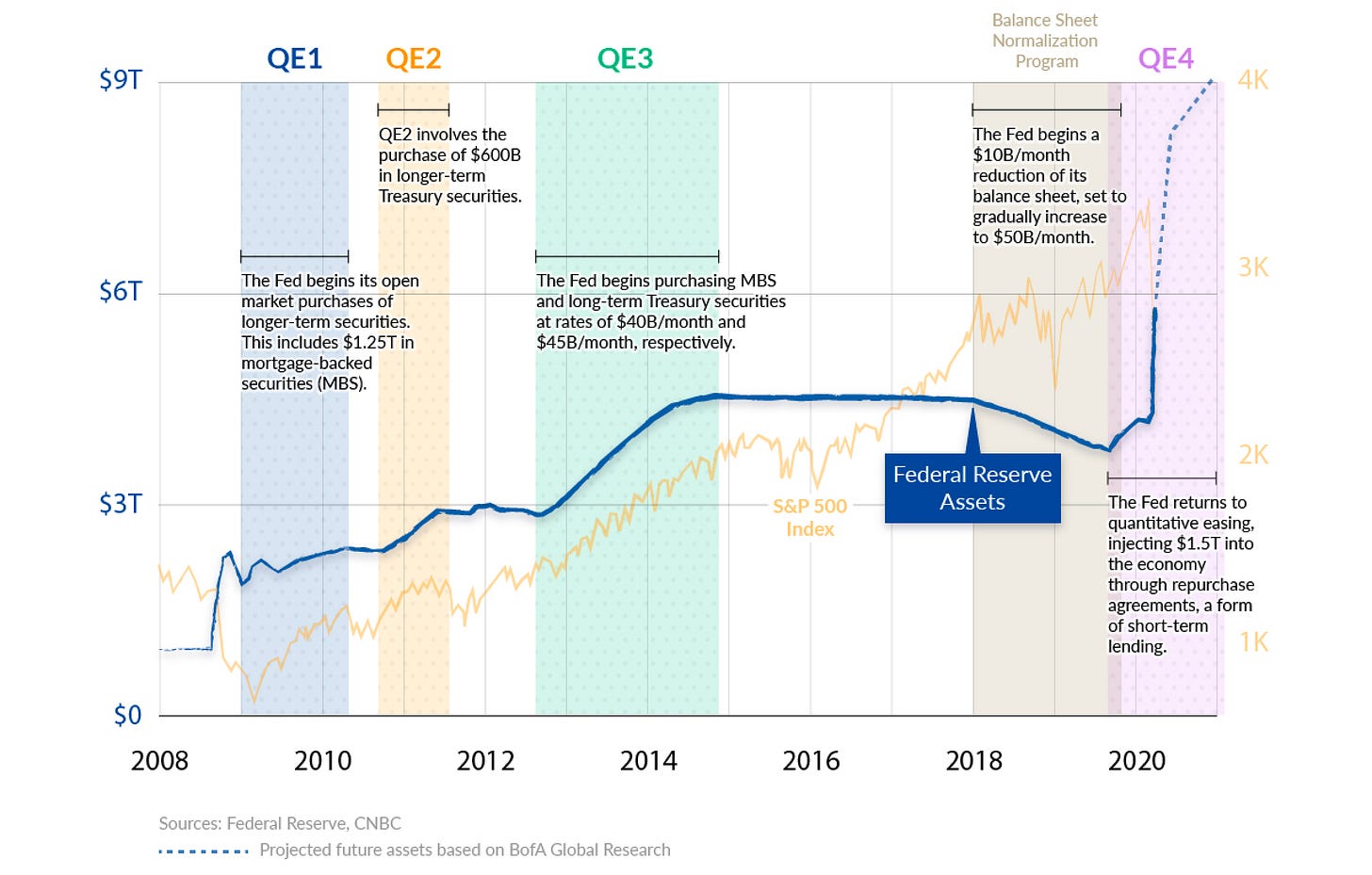

Because it takes time for lower interest rates to lead to increased economic activity, the central banks needed to do something more immediate as well. Because inflation was low, they embarked on something known as QE or Quantitative Easing. In quantitative easing, the central bank goes on a shopping spree and buys bonds and other assets (such as stocks). By doing this, the central bank accomplishes two things:

Increases liquidity: QE increases the overall money supply, making it easier for banks to borrow and lend money. This improves the overall availability of money in the financial system.

Reduces interest rates: When the central bank buys bonds, their prices go up and their yields (interest rates) go down. This makes it cheaper for banks to borrow money and lowers the cost of loans for businesses and individuals.

Exactly how much money did the US Federal Reserve print as part of QE? The amount is in the trillions since 2009:

With this combination of near-zero interest rates and excess availability of money, governments worldwide created a perfect environment for individuals and businesses to make risky long-term bets without worrying about financial viability:

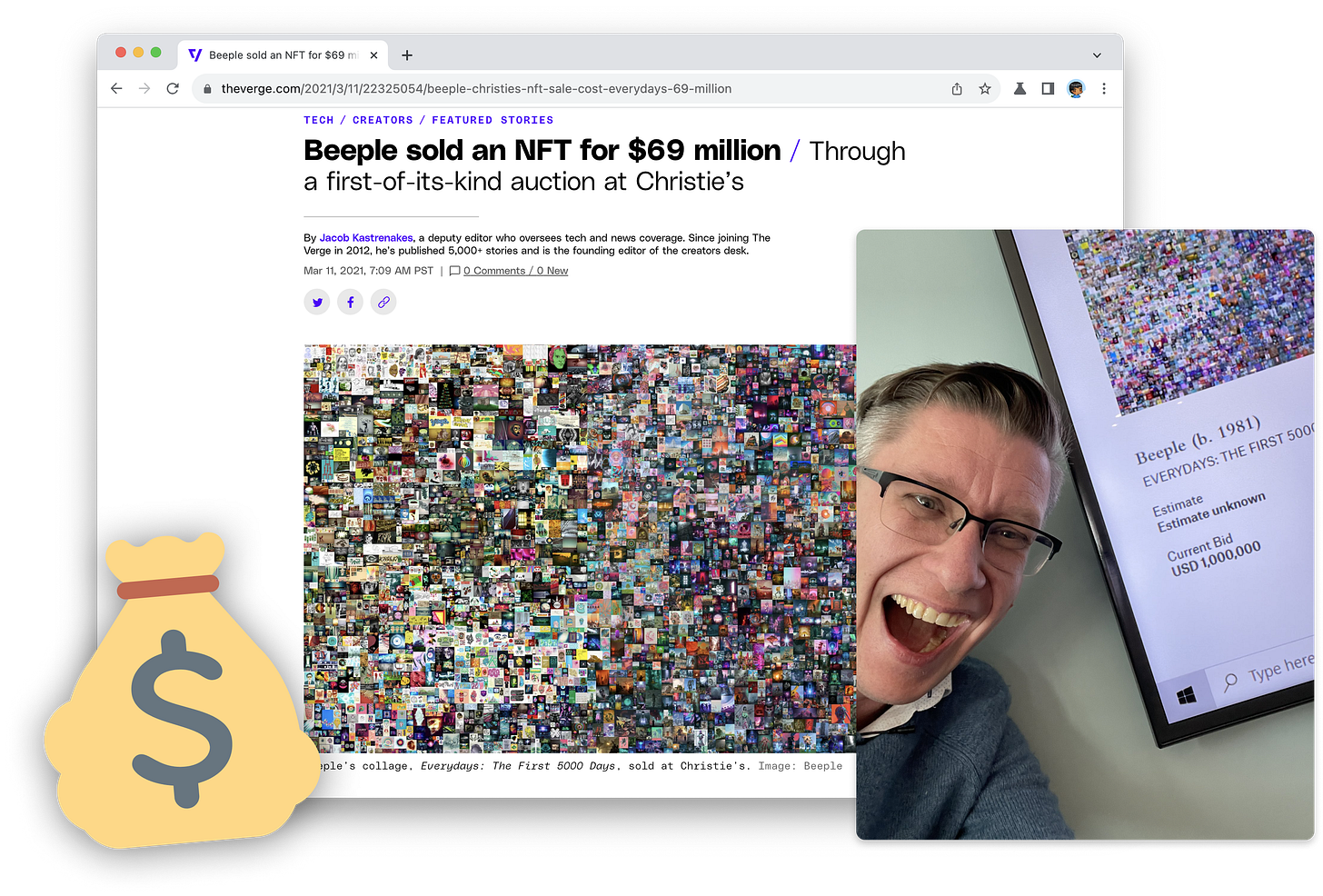

While all sectors of the economy benefited, technology companies benefited at a disproportionately larger scale. Tech hiring and associated wage growth greatly outpaced the general economy. Capital-intensive expenditures like new office buildings, new data centers, and more hit all-time highs. The tech-heavy NASDAQ and related growth stocks were unstoppable. Highly speculative investments like SPACs, cryptocurrencies, and NFTs, things unimaginable as having tremendous value at any other point in history, became huge:

It was a good time to be alive. It was a good time to be a part of the technology industry. It was a great time if you were beeple!

Bye bye, ZIRP and QE!

The good times lasted for a while. Depending on what timeframe you want to use, the technology industry had been in a massive growth phase since 2009 with only some minor hiccups in 2011/2012. During this time, inflation was also kept under control, providing the central banks with no real reason to slow down their policies. All of this started changing in 2020 when inflation started to steadily rise.

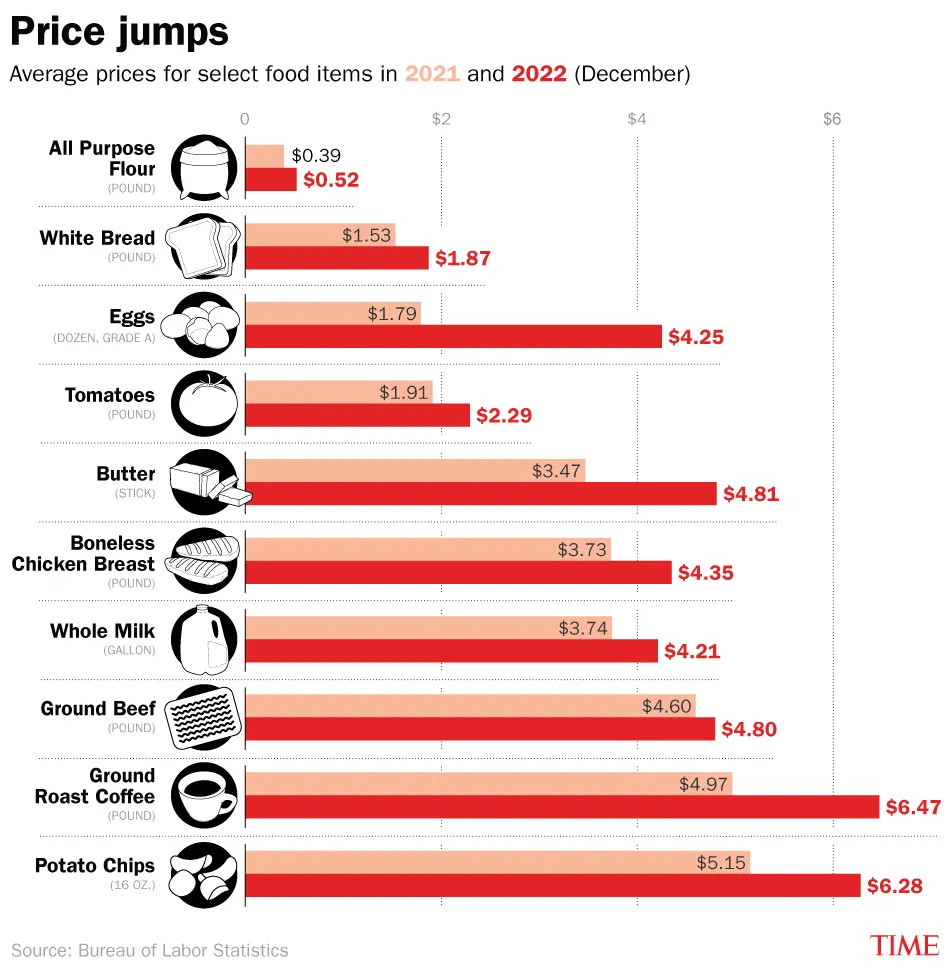

If it is one thing governments are terrified of, it is high inflation. It doesn’t make for positive headlines when everyday people start noticing an increase in the prices of items like groceries, rent, and gasoline. Unfortunately, this is exactly what started happening:

To turn the tide, the Federal Reserve started the process of rapidly undoing their actions of the past 10 years. They began hiking interest rates. They also stopped QE.

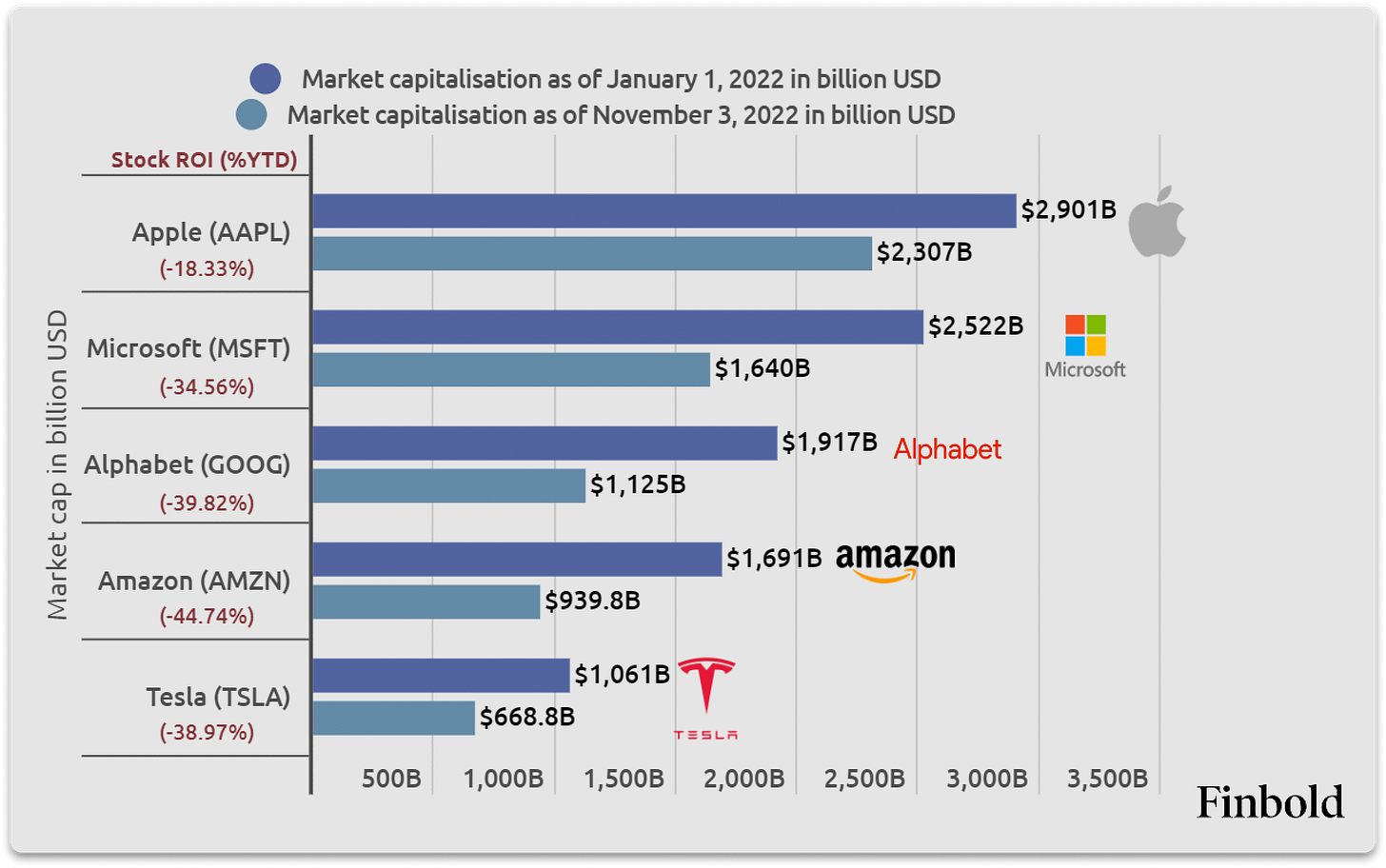

As a result of this reversal, borrowing became expensive. Large amounts of easy money were no longer being pumped into the economy. The stock market valuation of many tech and growth stocks that benefited the most from the ZIRP + QE environment started plummeting because future growth no longer matched their ZIRP-indexed lofty valuations:

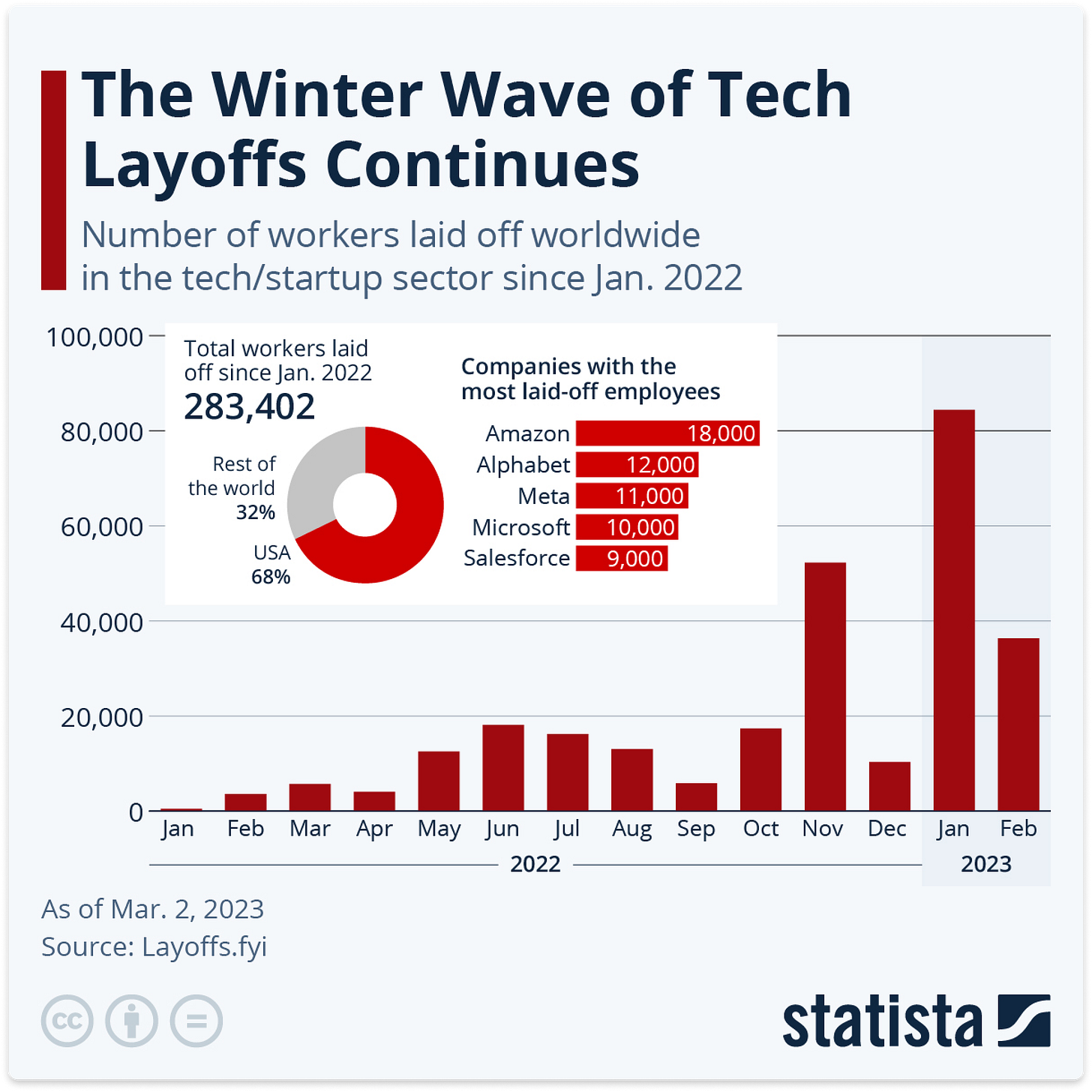

Things didn’t stop there. Companies started trimming expenses. They slowed down expansion plans. They cut budgets for many non-essential activities like travel and associated perks that had a negative cascading effect on local shops, restaurants, hotels, and more. They also started laying people off:

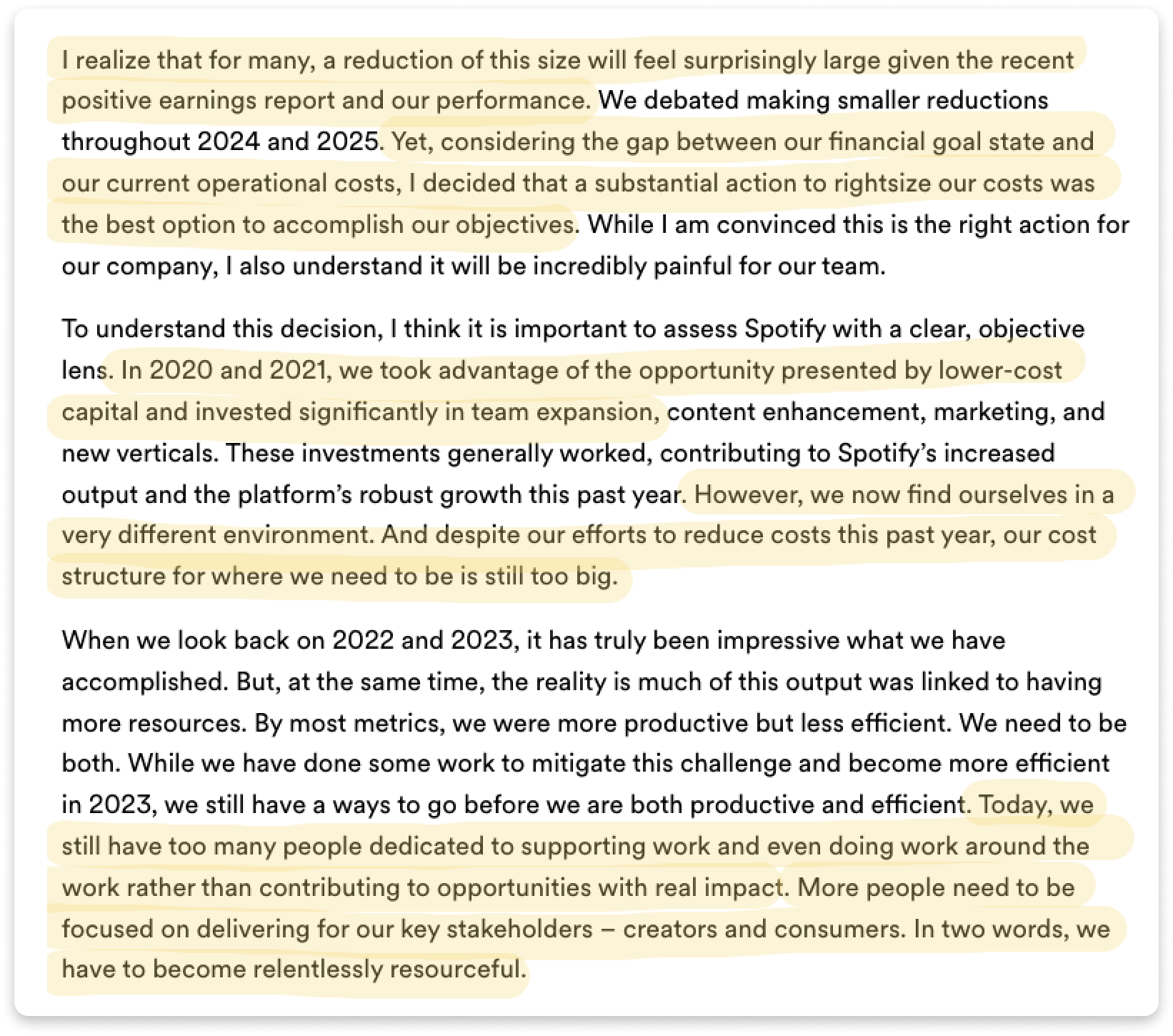

As of this writing (December 2023), the cost cutting continues. Inflation growth has slowed down, but it is still high. This means the central banks are forced to continue raising interest rates to levels not seen in many years. Almost all CEOs openly acknowledge the ending of the ZIRP regime is as one of the main reasons for the difficult times their companies are facing. The following is a statement by Daniel Ek, the CEO of Spotify, after his company’s layoffs a few weeks ago:

In these three paragraphs, Daniel cuts through the noise and directly summarizes so many of the points we’ve been looking at where higher interest rates and lack of access to unlimited free money isn’t great for high-growth technology companies.

Till Next Time

I hope this article and the previous two parts around interest rates and inflation helped paint a more comprehensive picture for you on how all of us in the tech industry ended up where we are. Often, the headlines we see in the news about interest rates, inflation, trade wars, balance sheets, etc. may seem very disconnected from the very technical and creative worlds that we live in. As these series of articles highlighted, everything is interconnected. When the economy hiccups, we are all going to feel it. The more we can observe and understand what is happening around us, the better we’ll be at exiting relatively unscathed through the bumpy ride we are all in.

Before I wrap this up, if you want to contact me, reply to this email, find me on Twitter/X, or post on the forums! I always enjoy hearing from readers like yourself.

Cheers,

Kirupa 😅

Thanks for sharing the article. Has been very useful. All three parts of them and it gives us a very good understanding of what's going on as developers. At times we have no clue what's going on, but it put things in perspective and gives us an understanding of what's of value and what what is worth. Of course it's it's good to live in a world where there's no interest. I think that's that's really the solution but hopefully you know things get for the better in 2024.