Tech Slowdown Explained, Part 1: Interest Rates 💸

Part 1 of our deep dive into how well-reasoned economic policies led to a slowdown in the tech sector.

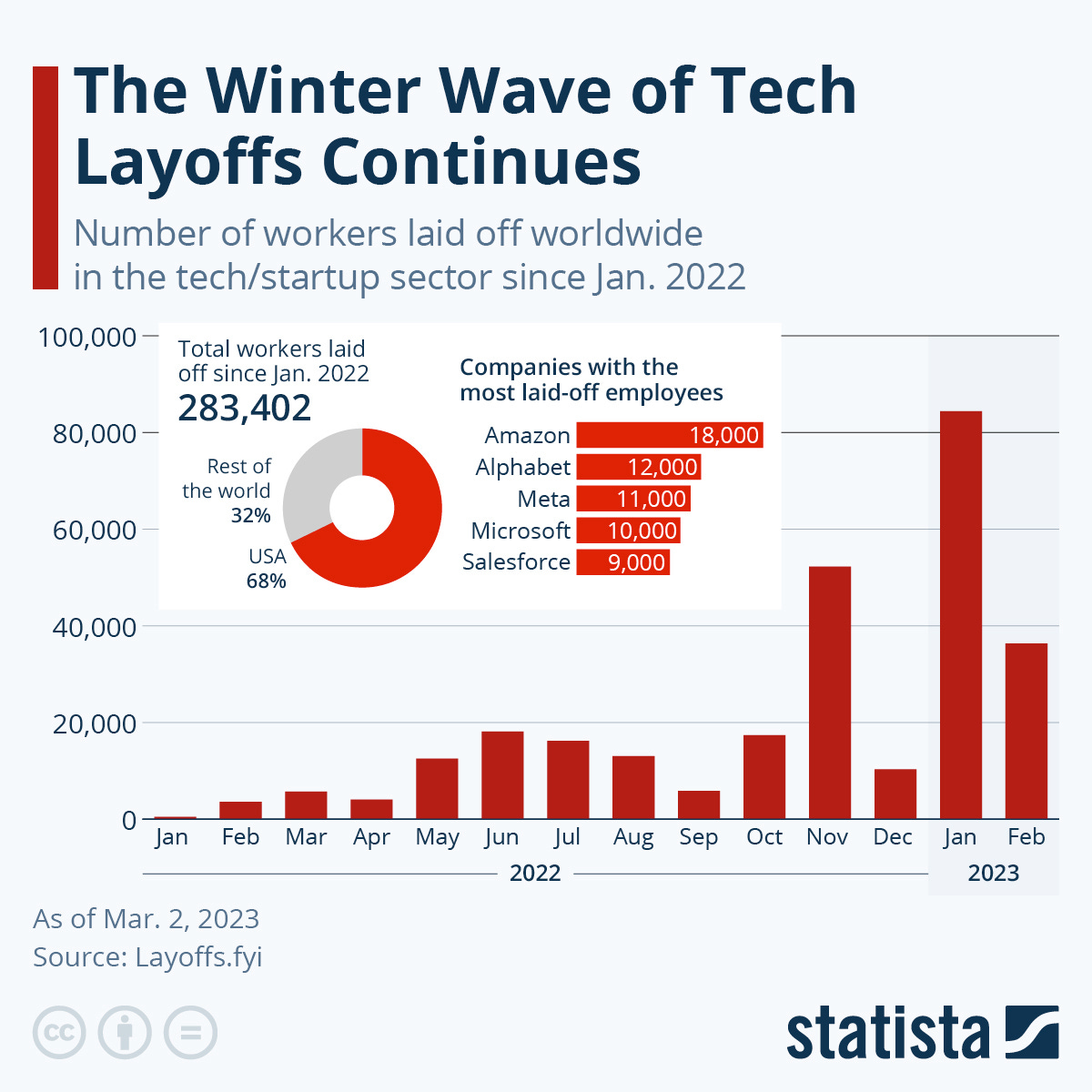

Whether you are working for a large company, a small company, or are working for yourself, you may have noticed that the tech industry is in a bit of a downturn:

This downturn isn’t just visible in terms of job losses. It’s harder than ever to land new clients, existing clients aren’t renewing their contracts, the job market is very competitive with limited openings, people aren’t buying/consuming our things as much as they used to, and so much more.

This slowdown in tech and other industries is not entirely accidental. It is a consequence of deliberate actions governments and their central banks worldwide have taken. Understanding why these actions were taken is important, for we don’t work in isolation from what is going on in the economy. The more we know about how economic changes impact technology trends, the more equipped you and I will be to make informed decisions.

That’s why we are going to be taking a detour from talking about technical topics and looking at this monetary side of our world across multiple parts. By the end of this series, you will have a greater understanding of how monetary policies have a direct impact on our day-to-day lives, both as technologists and as human beings.

Meet the Interest Rate

We are going to start our exploration at the beginning by focusing on interest rates, the real star of this very complicated situation. Here is the setup: we are running a business, and we decide to expand it. For this expansion, we will need $1000. We don’t have $1000 on hand right now, so we decide to borrow some money from a lending institution...like a bank:

In one version of the world, the bank gives us the $1000 we asked us for. After an agreed-upon time, we pay the bank back. The amount we pay back is the $1000 that the bank originally gave us:

Seems reasonable, right? The kicker is that this version of the world doesn’t exist. Almost always, the bank will charge us a fee for the privilege and convenience of borrowing money from them. This fee is known as interest, and it is often specified as a percentage (aka the interest rate) of the amount we borrowed.

For example, the bank may charge us an interest rate of 10% to borrow $1000 from them. This means when we pay back the bank, we pay both the originally borrowed amount ($1000) as well as an additional $100 ($1000 x 10%) as interest:

The total amount we pay is $1100. The higher the interest rate, the more we end up paying in total. The lower the interest rate, the less we end up paying.

How are Interest Rates Calculated?

While the 10% interest rate in our example is arbitrary and used to make our math easier, the actual interest rate is determined by many factors ranging from how trustworthy you are, how long you will take to pay back the loan, the riskiness of what you plan to use the money for, how well you negotiate with competing offers from other banks, and a handful of other details.

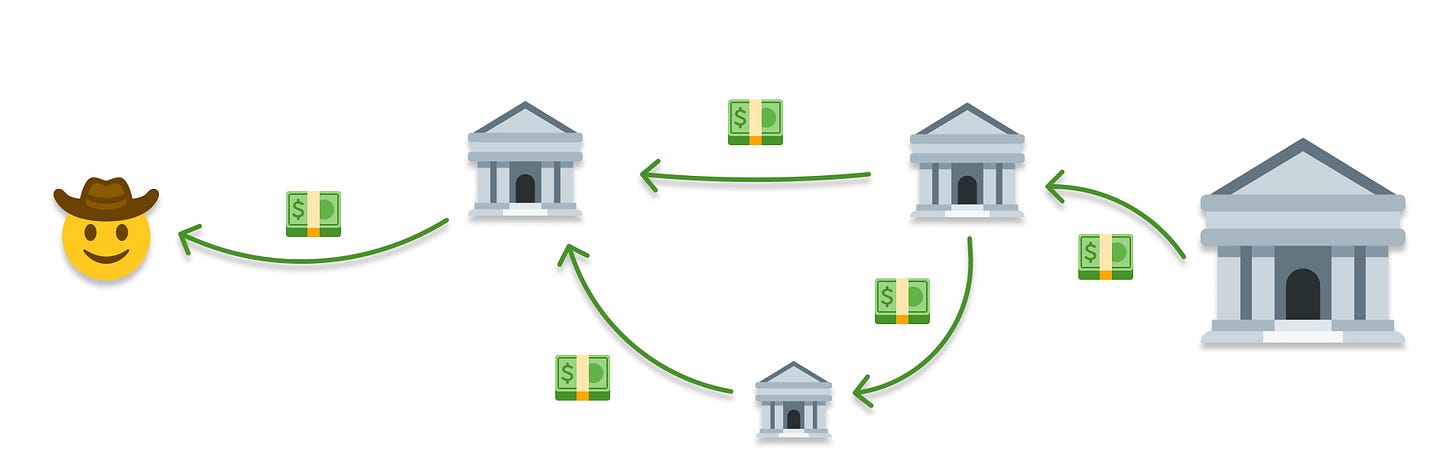

As with many things, there is a large, fungible part to the interest rate. If we take away all of those negotiable pieces, there is in one factor that plays an outsized role in setting the interest rate. That factor is the rate banks charge other banks for borrowing money between them. Why would banks borrow money from other banks? Banks don’t always have money in a liquid or easily accessible form. By law, they are required to keep only a small portion of the money deposited into them in the form of easily available cash. This is part of the fractional-reserve banking style all of our banks operate under. For the remaining larger portion, banks are free to invest and pursue profitable ventures on their own.

While this sounds scary, outside of a few rare misses, this arrangement works well. An example of a rare miss would be what happened to Silicon Valley Bank recently:

Getting back to our example, it is highly likely that our bank doesn’t have $1000 of its own money easily available to lend to us. What it does is borrow that amount from another bank, which may, in turn, borrow from another bank:

Each level of interconnectedness between the banks incurs a small fee, and this fee is something that the bank will ultimately recoup from us as part of the interest they charge.

Now, what is the biggest and baddest bank of them all?

That would be the central bank that is tied to the government. In the United States, that bank (or series of banks) is the Federal Reserve. The Federal Reserve, being the source for much of the money that gets distributed, sets the minimum rate banks charge between themselves for borrowing money. This rate is known as the Federal Funds Rate. The higher this rate, the more expensive it is for banks to borrow money. This added expense is passed on to us in the form of higher interest rates.

Federal Funds Rate and Interest Rates

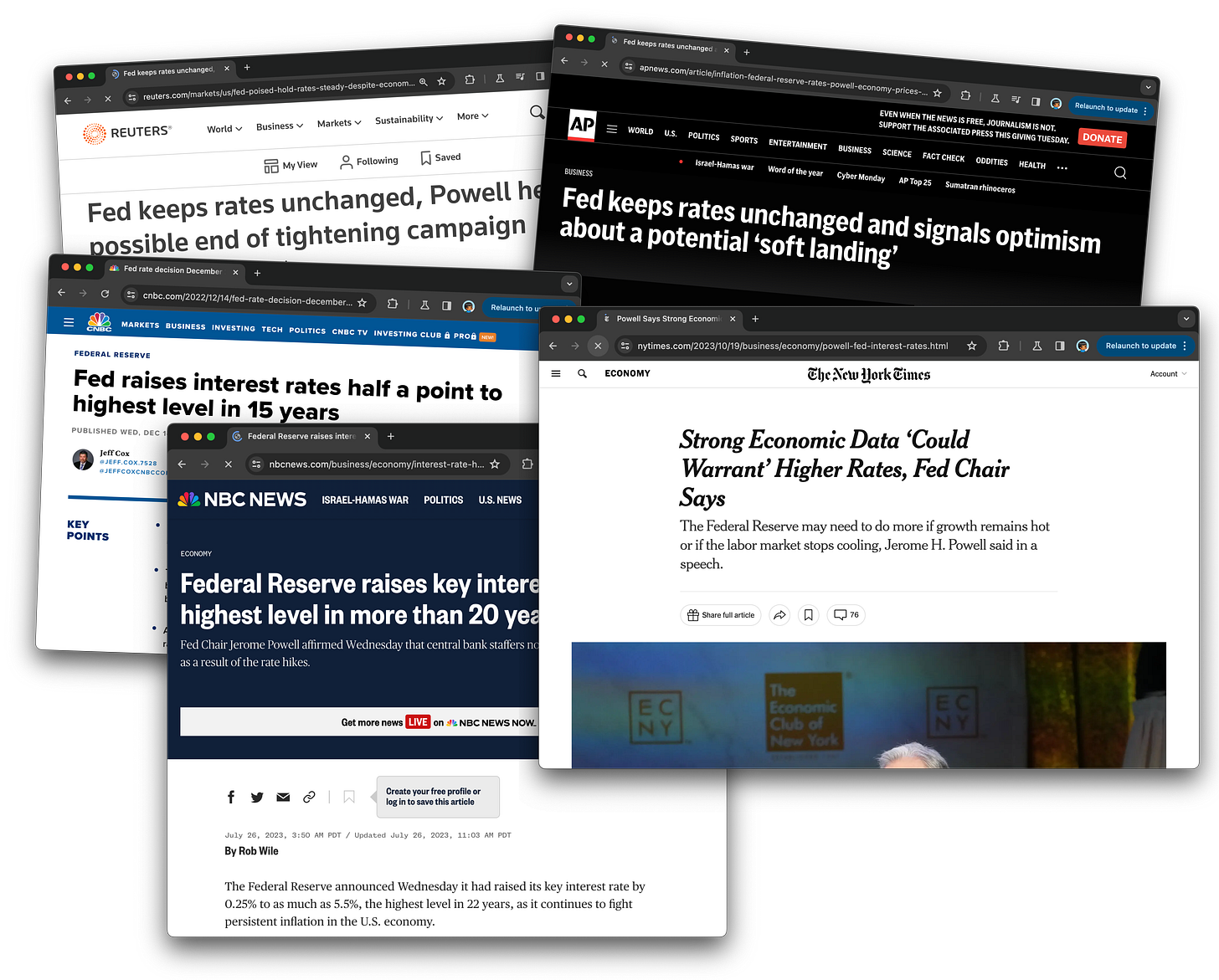

Because the Federal Funds Rate plays an outsized role in determining the interest rates banks charge us, any changes to the Federal Funds Rate will make headlines:

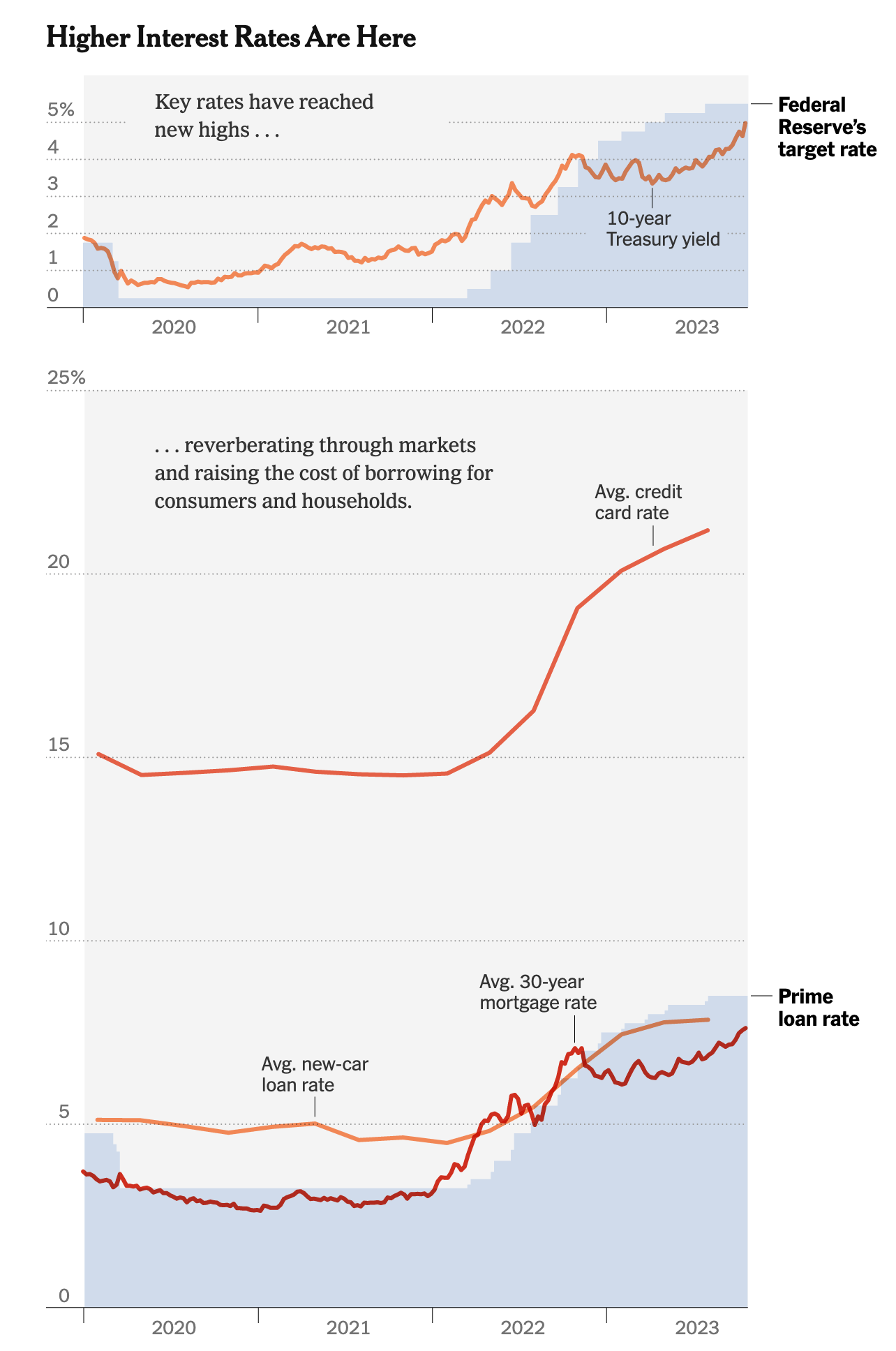

Over the past few years, the Federal Reserve has been drastically increasing the Federal Funds Rate, which has, in turn, increased the interest rate we see for everything from business loans, car loans, home loans and more as highlighted by the following visual from the New York Times:

As we talked about earlier, the lower the interest rate, the better off we are as borrowers. For our $1000 loan, an interest rate of 2% would mean that we pay the bank a total of $1020. For the same loan amount, an interest rate of 10% would mean we pay back a total of $1100.

In our example, we are treating the interest rate and the final amount as a one-time fixed payment. Most loans are paid off over a period of 10 years, 15 years, or 30 years. When the payments are spread across such a long period of time, minor changes in the interest rate have a much larger impact on the total amount we pay. This will be an important factor we look at in our next article in this series.

Till Next Time

To reiterate a point from earlier, you and I work within the broader context of the economy. Changes in monetary policies and interest rates can have a significant impact on economic conditions, which, in turn, influence the demand for technology products, services, and employment. Our coverage of interest rates here is just the beginning, so stay tuned for subsequent articles that go deeper into how interest rates impact inflation, which impacts whether governments hit the brakes or hit the gas on the economy.

As always, if you want to contact me, reply to this e-mail, find me on Twitter/X, or post on the forums!

Cheers,

Kirupa 🤠