Tech Slowdown Explained, Part 2: Inflation 🐉

Inflation is the thing that everybody tolerates but nobody wants too much of. Let's find out what inflation is and why it is always hanging around.

In the first part of this three-part series, we looked at the basics of what interest rates are and the role the government and central banks play in helping set the rate. A big takeaway is that lower interest rates are good for borrowers because it reduces the total amount that one has to pay back.

By all accounts, keeping interest rates low seems great, right? Why don’t governments do what they can to keep interest rates as low as possible? The answer to this has to do with a little dragon (🐉) known as inflation.

What is Inflation?

Let’s start with a definition: inflation refers to an increase in the prices of goods and services over time. When we encounter inflation, the money we have today buys less of the things we need. The formal way of describing it is that our money loses some of its purchasing power, and the $1 dollar in our pocket (or under the mattress 🛏️) doesn’t go as far as it once did.

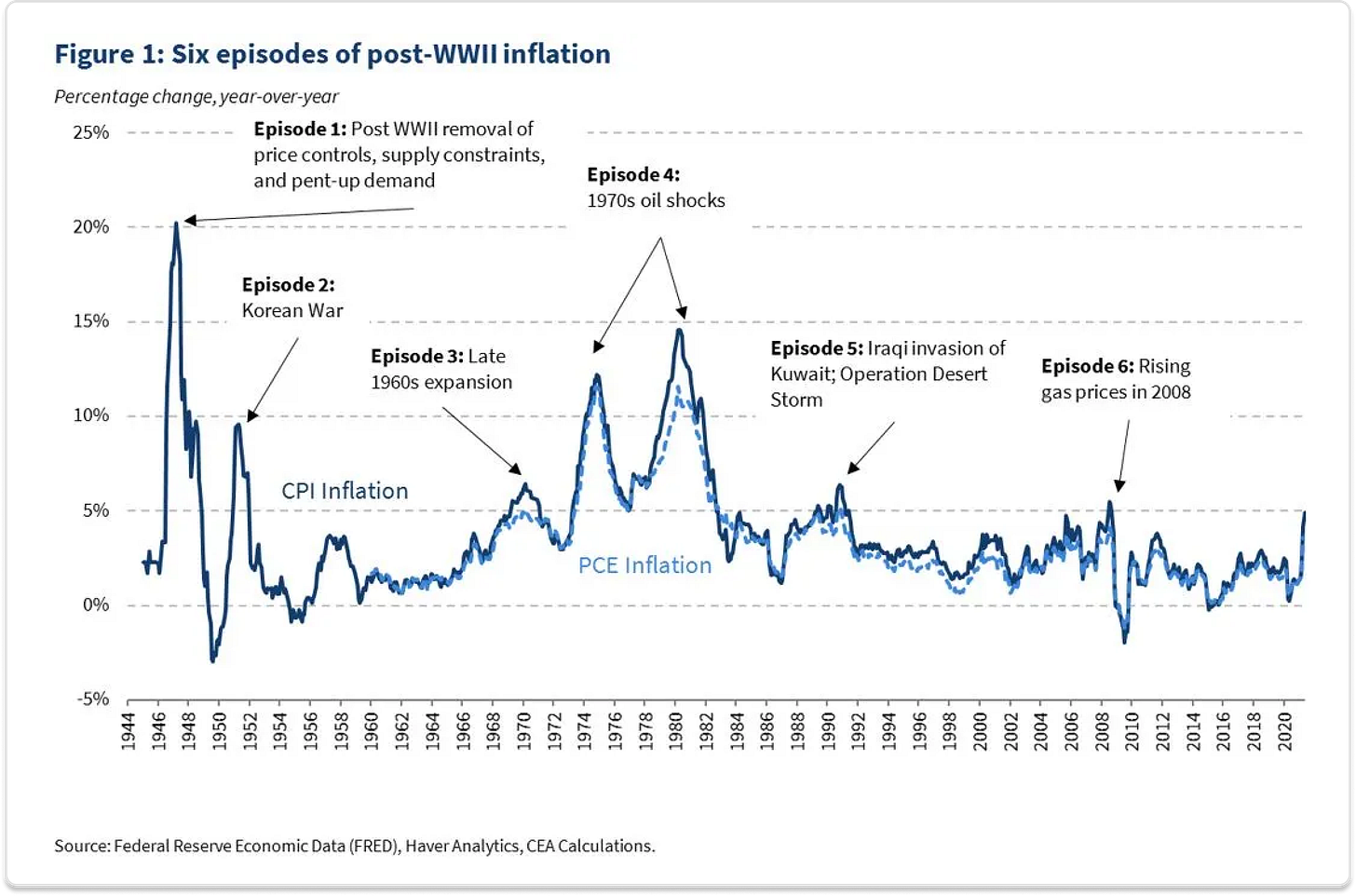

Now, this description makes it sound like inflation is bad. That’s not exactly the case. As with many things, the key is moderation. A little bit of inflation is actually good, and almost all of us have lived in a period over the past 30 years where we have had low to moderate amounts of inflation:

Moderate inflation has been good for us in the United States because the inflation we observed was coupled with good economic growth. While inflation did cause the costs of many goods and services to go up, there was a larger increase in wages that offset this rise in costs. To look at this from a historical view, while a dozen eggs cost $0.23 in 1900 compared to $1.23 in 1990, the average yearly income also rose from around $400-ish to about $23,000. Not too shabby!

Now, what exactly causes an increase in the costs of goods and services that leads to inflation? There are a few big factors:

Increased demand. When the demand for something exceeds the supply, this causes an increase in prices. This demand can be caused by increases in consumer spending, government spending, and/or private investment.

Higher production costs. If it costs more to produce something, those costs will be passed on to consumers in the form of higher prices. Examples of inputs that lead to higher costs are increased wages, rising raw material prices, higher energy costs, and so on.

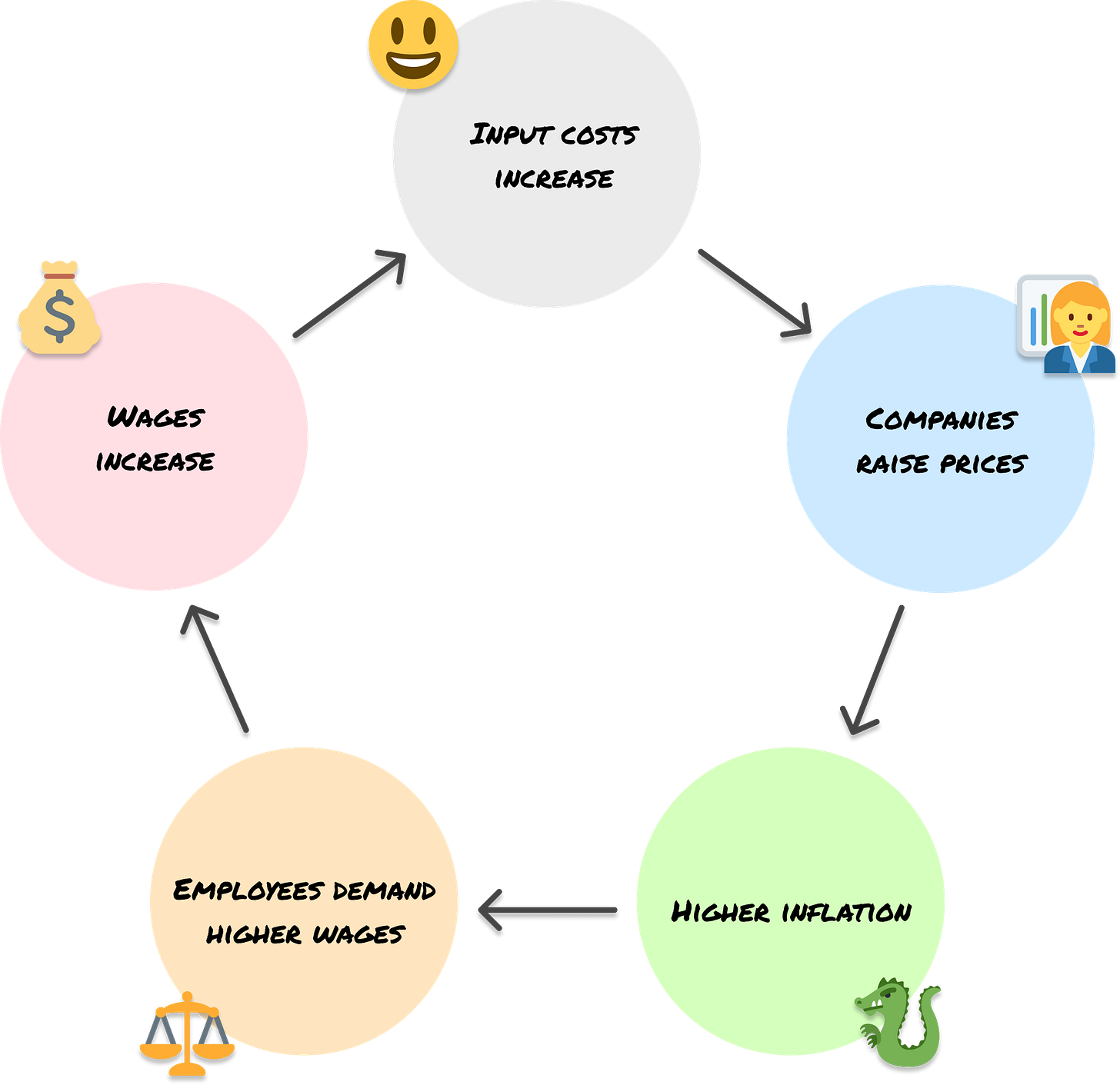

Wage-Price spirals: When workers demand higher wages to cope with rising prices, businesses may respond by increasing prices to maintain their profit margins. This cycle of wage increases and price hikes can create a loop, contributing to inflation:

Excess money supply: Central banks play a crucial role in controlling the money supply through monetary policy. If they pump more money into the system to help jumpstart a slowing economy, this availability of easy money can lead to inflation.

There are a bunch more factors at play, such as currency valuations, natural disasters, geopolitical strife, and so on, but these are the big ones that we’ll often see talked about directly or indirectly when we hear about inflation in the headlines.

Inflation and Interest Rates

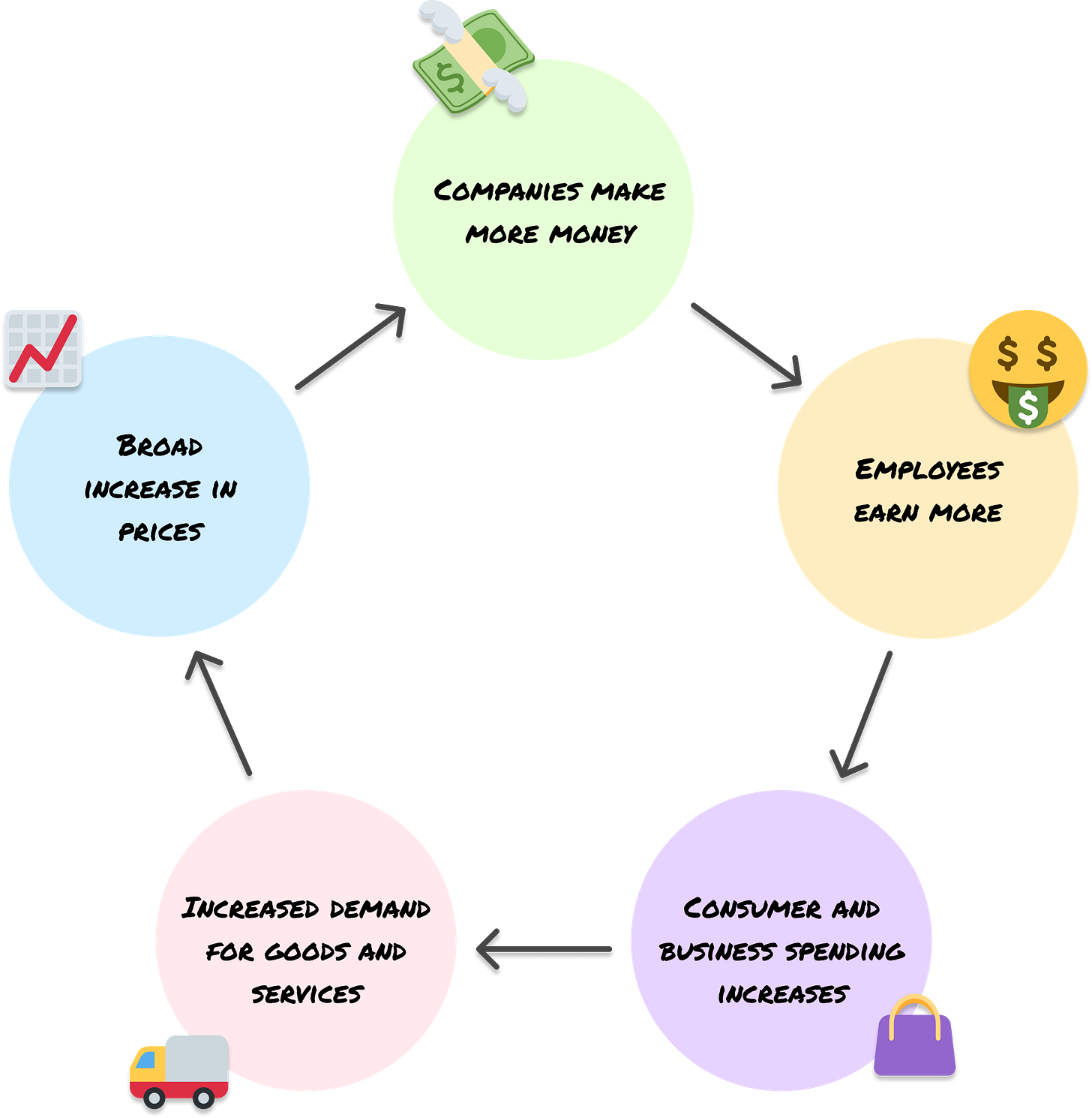

There is a strong relationship between inflation and interest rates. Inflation is a natural side effect of a rapidly growing economy, and the following diagram highlights the cycle of growth and increased prices:

We don’t want too much inflation. We also want economic growth. How does the government balance these seemingly opposite ends of a spectrum?

They balance by using their ability to influence interest rates. Higher interest rates make borrowing money more expensive, so businesses and people naturally reduce their spending. In a consumer-driven economy like that of the United States, that reduction in spending will have a ripple effect across all industries and slow economic activity down. A slower economy means that the various switches that lead to higher prices will be turned off...leading to lower inflation.

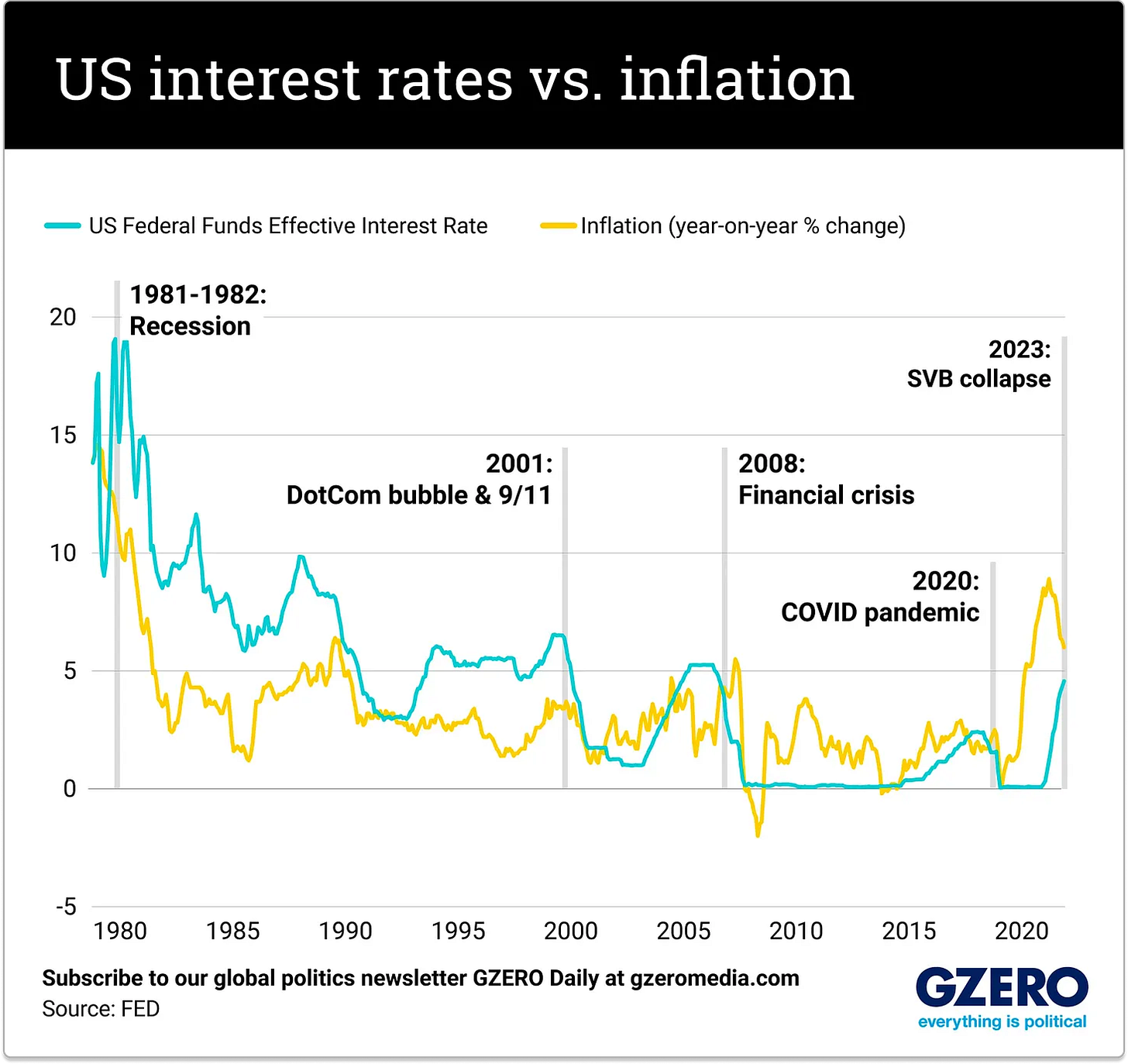

We can see this inverse relationship between inflation and interest rates play out by looking at the following chart:

During periods of high inflation, the government raised rates to bring inflation under control. When the rates became too high and ground economic growth to a halt, the government reversed course and reduced rates.

On the surface, it seems simple to raise and lower interest rates to optimize for the perfect amount of inflation. What makes this a nearly impossible task are two things:

The time it takes to adjust rates and measure the impact on inflation can often take years. Imagine you are driving and see some traffic ahead. You start to hit the brakes. Instead of your car reacting to the brakes immediately, your car may take an unknown amount of time before it slows down. If you slow down too much and hit the accelerator, you won’t gain speed immediately as well. There will be a lag here, also. This is what trying to control inflation is often like! 🐈

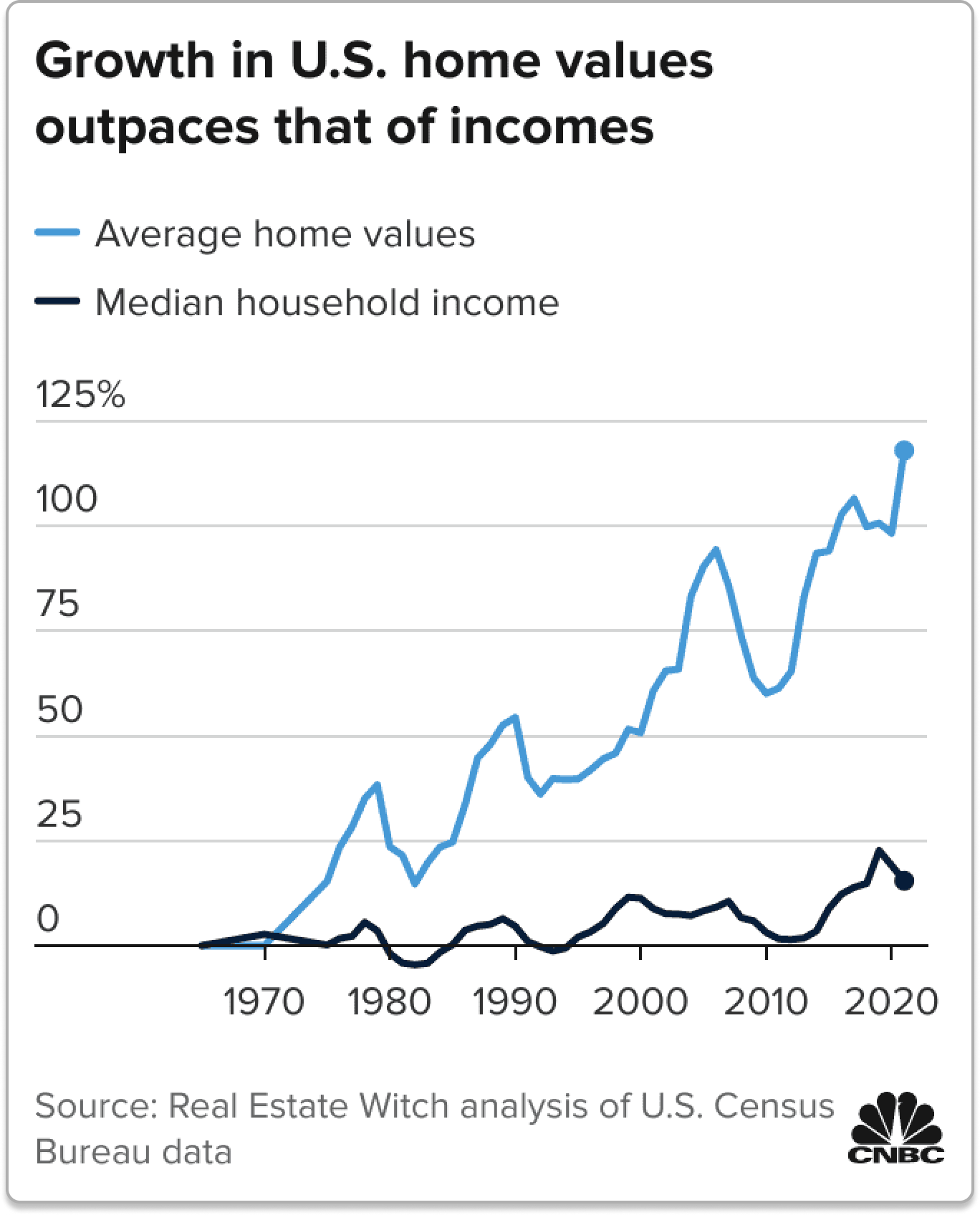

Different parts of the economy can react unpredictably to adjustments in rates. Not everything is as simple as measuring the price of an egg. Over the past few decades, the government’s ability to control inflation and the costs of various goods and services has been mixed. While the costs of many everyday goods have gone down significantly, the costs of housing and college tuition have increased at a rate far greater than the average income:

Various sectors of the economy react to higher interest rates and inflation differently as well. For example, the technology sector suffers greatly in higher interest rate scenarios, whereas many financial institutions tend to fare well when interest rates are high.

All of this is to say that nobody has a magical answer for how to keep interest rates low, keep inflation low, maintain positive economic growth, and ensure people are economically happy. It’s a balance that requires constant adjustment and measurement.

Till Next Time

With our coverage of inflation today and interest rates previously, we are edging ever closer to talking about why the technology sector is seeing major slowdowns. In our third and final part of this series, we’ll wrap everything up by looking at how the long-running zero-interest rate policy (aka ZIRP) led to rapid growth in technology companies…and led us to whatever we are in right now.

As always, if you want to contact me, reply to this email, find me on Twitter/X, or post on the forums!

Cheers,

Kirupa 😅